Financial advisors and the economy

Most of my discussions about money with people goes like this:

“blah blah blah and this is how I was able to consistently earn money for the past 5 years”

“Wow you are very knowledgeable about investing, are you a financial advisor?”

“No, I just trade a lot”

~silence

You can almost see the respect drain out of them. This happened enough that I just want to get certified for the sake of saying yes with conviction at one point and find out how people would react. What is disconcerting to me though is how people rely on a piece of paper… a title to chose the advice they’d listen to on matters of money.

For me, I have lost faith in financial advisors long ago. Rather, the moment I found out that they are compensated based on a fee commission structure and their job security has nothing to do with how well their client’s portfolio ended up being, but rather, the amount of transactions. Most of the banking industry’s compensation structure are not tied to the performance of the money they manage. Get this into your head now.

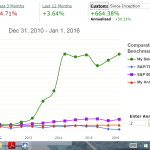

Nowadays, when I encounter someone knowledgeable, I ask for their track record instead. Something so obvious, yet nobody asks for. 5 years of experience is the minimum passable grade with 10 years an ok grade. One level up if you are able to consistently make money for those years. If everyone used this as their guide, there’d be a lot less angst in the world right now. Then again, we’d just be creating another bubble if everyone made too much money.

I should be thankful for these financial advisor’s recommendations. Without them, I wouldn’t have been able to get ahead.

Leave a Reply